What are positive outcomes from filing bankruptcy?

Ruby Norta Gumapac Assistant at Ascent Law LLC

One of the many positive outcomes of filing for bankruptcy is a new start. Although you may be forced to give up some property, bankruptcy will give you a clean slate to start afresh. In addition to getting a new financial start, bankruptcy will also improve your credit score. You may also benefit from credit education.

As filing for bankruptcy is a major step, it is important to consider all options before choosing to file. The consequences of bankruptcy can be devastating. You could lose a lot of assets and income, and it will also severely damage your credit rating. If you are considering filing for bankruptcy, a credit education course can help you review your finances and make smarter financial decisions. Once you complete the course, you’ll receive a certificate that you can submit with your bankruptcy petition.

You may have to give up some property

If you have non-exempt property that you owe money on, you may have to give it up to the bankruptcy trustee. The bankruptcy trustee will then sell this non-exempt property to pay your creditors. While you may have some equity in the property, it might not be exempt if you owe money on it secured by a mortgage or car loan. If this is the case, you will have to give up some property in order to keep all of your debt-free assets.

Filing for bankruptcy is a last resort and comes with risks. If you are unable to afford a payment plan and have some property, filing for bankruptcy may be the best option. Bankruptcy will allow you to start fresh. However, you may have to give up some property after filing. Fortunately, there are exemptions to protect some of your assets.

You can get a fresh start

Bankruptcy is a legal process that can give you a fresh start in life. Filing bankruptcy releases debtors from personal liability and prevents creditors from taking collection action against them. It also prevents creditors from filing lawsuits against them, which helps debtors keep their cars and belongings. However, if you wait too long to file, you could risk losing your assets.

In order to qualify for a fresh start bankruptcy, you must meet certain requirements. For example, you must earn less than the average household income in your area. You should also have a high enough level of debt so that you can’t pay off your debts within the next five years with your current income.

Your credit score improves

Your credit score will improve after bankruptcy if you make on-time payments on all accounts and make responsible use of your credit cards. Since the bankruptcy will have a negative impact on your credit for at least 10 years, it is critical that you rebuild it responsibly. It is important to pay off any outstanding debts and build an emergency fund. It is also important to be vigilant about checking your credit report for errors and ensuring any negative marks are removed promptly.

Bankruptcy affects everyone differently, and a bankruptcy will hit those with better credit the hardest. However, it is possible to lower unsecured debt to 40% or less, and pay off the rest of it promptly. Credit scores are the determinants of how much you can borrow and for how much it will cost. Bankruptcy can make it difficult to qualify for low-interest loans, so it is important to understand how bankruptcy affects you.

You can rebuild your financial life

Rebuilding your financial life after filing bankruptcy requires a lot of patience and hard work. You have to be able to prove to creditors and employers that you are now in a better position financially. If you want to buy a house or car, for instance, you need to rebuild your credit history and show lenders that you are in control of your finances. You can start by setting up autopay on your credit cards, which can keep your payments on time. Also, keep your credit card debt to less than 10% of your available credit.

If you are still in debt, you can make small changes in your lifestyle to reduce your expenses. Make a budget and stick to it. You can even use the Budget Calculator to find out how much money you need to save. You can also start making extra cash to help you with unforeseen expenses.

If you need an Bankruptcy Lawyer, please call this law firm for a free consultation.

Ascent Law LLC

8833 S Redwood Road Suite C

West Jordan UT 84088

(801) 676-5506

When you need a Divorce Lawyer, contact this law firm:

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC

Recent Posts

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Murray, Utah

|

Murray, Utah

|

|

|---|---|

|

City

|

|

Murray City Hall

|

|

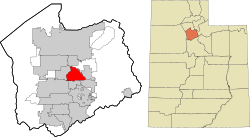

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°39′9″N 111°53′36″WCoordinates: 40°39′9″N 111°53′36″W | |

| Country | United States |

| State | |

| County | Salt Lake |

| Settled | 1848 |

| Incorporated | January 3, 1903 |

| Named for | Eli Houston Murray[1] |

| Government | |

| • Type | Mayor-Council |

| • Mayor | Brett Hales[2] |

| Area | |

| • Total | 12.32 sq mi (31.92 km2) |

| • Land | 12.32 sq mi (31.91 km2) |

| • Water | 0.00 sq mi (0.01 km2) |

| Elevation | 4,301 ft (1,311 m) |

| Population

(2020)

|

|

| • Total | 50,637 |

| • Density | 4,110.15/sq mi (1,532.75/km2) |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP codes |

84107, 84117, 84121, 84123

|

| Area code(s) | 385, 801 |

| FIPS code | 49-53230[4] |

| GNIS feature ID | 1443742[5] |

| Demonym | Murrayite |

| Website | www |

Murray (/ˈmʌri/) is a city situated on the Wasatch Front in the core of Salt Lake Valley in the U.S. state of Utah. Named for territorial governor Eli Murray, it is the state’s fourteenth largest city. According to the 2020 census, Murray had a population of 50,637.[6] Murray shares borders with Taylorsville, Holladay, South Salt Lake and West Jordan, Utah. Once teeming with heavy industry, Murray’s industrial sector now has little trace and has been replaced by major mercantile sectors. Known for its central location in Salt Lake County, Murray has been called the Hub of Salt Lake County. Unlike most of its neighboring communities, Murray operates its own police, fire, power, water, library, and parks and recreation departments and has its own school district.[7] While maintaining many of its own services, Murray has one of the lowest city tax rates in the state.[8]

Thousands of people each year visit Murray City Park for organized sports and its wooded areas. Murray is home to the Intermountain Medical Center, a medical campus that is also Murray’s largest employer. Murray has been designated a Tree City USA since 1977.[7]

What Are Positive Outcomes From Filing Bankruptcy?https://t.co/Q4kh4MDIaW pic.twitter.com/VzLrMETQn6

— Ruby Norta Gumapac (@NortaRuby) October 30, 2022

Comments are closed.